India is positioning itself to reclaim its share in China’s rapeseed meal market, leveraging a significant price advantage over global competitors amid tightening supplies and rising international rates.

TheSolvent Extractors’ Association (SEA) has urged the Ministry of Commerce to engage Chinese authorities in relaxing import restrictions, which currently limit exports to just three Indian facilities approved by China’s customs administration.

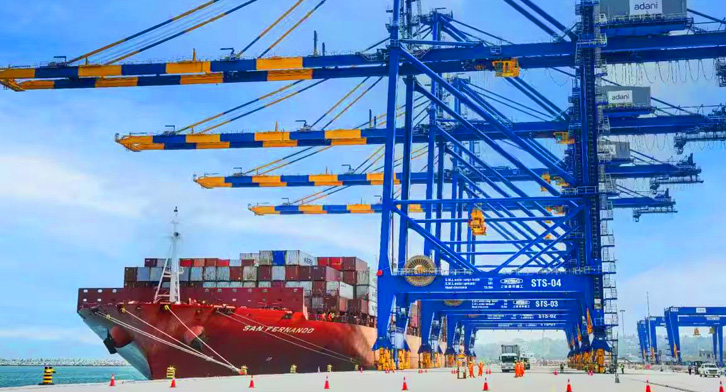

With Indian rapeseed meal priced at $202/tonne (Ex-Kandla FAS) versus $308/tonne (Ex-Hamburg) internationally, Indian exporters see a strong opening to re-enter the Chinese market—especially as China faces supply constraints from its main suppliers, Canada and the EU.

However, the Indian oilmeal export sector is also contending with competition from Distillers Dried Grains with Solubles (DDGS), a protein-rich ethanol byproduct increasingly used in animal feed, which may impact traditional demand.

Despite record harvests in soybean and mustard crops boosting domestic meal supply, global price disparity continues to dampen export demand.

Key Takeaways :

- Price Edge: Indian rapeseed meal at $202/tonne vs international rate of $308/tonne, creating strong export potential.

- Limited Access: Only 3 Indian plants are currently approved by China for rapeseed meal exports.

- SEA's Appeal: Industry body urges government to push for relaxed Chinese import norms.

- Market Opportunity: Supply constraints in Canada and EU open doors for India in China’s animal feed market.

- DDGS Disruption: Rise of ethanol byproduct DDGS is reshaping feed industry demand and competing with traditional oilmeals.

- Production Boost: Record soybean and mustard harvests have increased meal availability in India.

- Export Slowdown: Export demand remains weak due to uncompetitive international pricing.

- April Export Stats:

- Total oilmeal exports: 4,65,863 tonnes (up from 4,65,156 tonnes in April 2024)

- Rapeseed meal exports: 2,13,023 tonnes

- Soybean meal exports: 2,30,743 tonnes