India’s merchandise trade with G7 nations has hit a major milestone, recording a $28 billion trade surplus in FY25, according to a new analysis by Rubix Data Sciences.This performance reflects a strong 13% CAGR in trade with the G7 bloc since FY21.

The growth is driven primarily by surging exports of smartphones and pharmaceutical products, reinforcing India’s rising role as a trusted global supplier to some of the world’s most advanced economies.

Key Highlights:

- Total G7 trade in FY25:

- $248 billion in bilateral goods trade

- $138 billion in exports

- $110 billion in imports

- Resulting in a $28 billion surplus

- Trade surplus sustained with 4 out of 7 G7 members:

- United States

- United Kingdom

- France

- Italy

- Top Indian exports:

- Smartphones & telecom equipment

- Pharmaceuticals & generic medicines

- Smartphone exports:

- Grew 55% year-on-year,reaching $24 billion in FY25

- Pharma dominance:

- India supplies 40% of U.S. generic drug demand

- Covers 25% of U.K.’s total pharmaceutical consumption

- Changing trade dynamics:

- India’s export share to G7 rose from 29% to 31% in 5 years

- Imports from G7 dropped from 18% to 15%, improving trade balanceutical consumption

Expert Insight:

“India’s trade surplus with the G7 reflects the rising global confidence in Indian manufacturing and MSMEs,” said Mohan Ramaswamy, Co-founder & CEO of Rubix Data Sciences. “From cutting-edge smartphones to life-saving drugs, Indian exports are gaining significant traction in mature markets.”

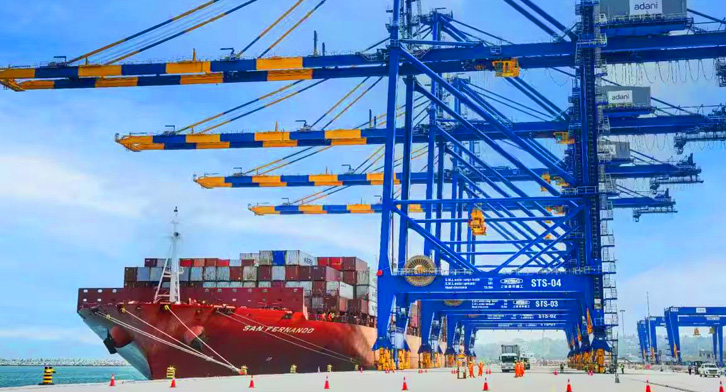

Why It Matters for Logistics & Trade Professionals:

- G7 markets are becoming more dependent on Indian supply chains.

- Logistics players should prioritize capabilities in tech, pharma, and high-value cargo handling.

- There’s clear evidence of resilience and competitive pricing in Indian exports, creating room for freight forwarders and NVOCCs to offer tailored trade-lane solutions.